Oatly's global storytelling

Oatly is the original mass oat milk brand, creating a new category in Western markets by combining product innovation with highly impactful, irreverent storytelling.

Yet, Oatly were facing a multi-tiered challenge growing their business in Japan.

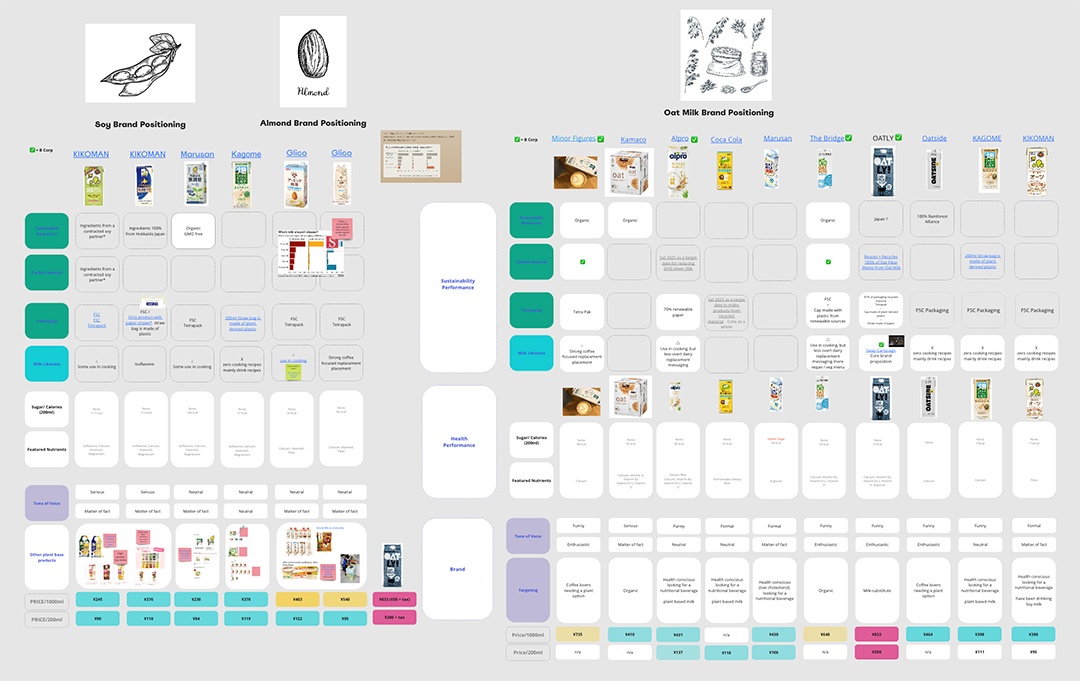

Japan has a range of established alternative milk options, but most people are unfamiliar with Oat milk.

At the same time, Oatly’s distinct storytelling had yet to find the right level of nuance for Japanese audiences.

We helped Oatly understand the behaviours and beliefs of Japan’s conscious consumers, shifting preconceptions drawn from their experience in other markets.

Our team leveraged their sustainability expertise in the Food and Beverage space to run a series of sprints unpacking Oatly’s challenges.

This involved a research process where we synthesised insights from:

Research outcomes: Insights were used to iterate on the marketing strategy for Oatly Japan, impacting storytelling and media content going forward.

Our sustainability database identified younger and older groups as the most sustainable, each open to alternative milk products for different reasons.

Younger audiences (Generation Z) were open to societal changes and cultural trends, which led to experimental choices in their milk and coffee products, although their limited income make pricing a challenge.

Older audiences (Boomers) had the highest sustainability consciousness and milk intake, although a potential barrier is their longstanding support for Japanese farmers.

Generation Z (aged 10-25) interested in plant based milk products.

Generation Z appreciated the rich, full bodied taste of Oatly.

Generation Z wouldn’t pay more for sustainable food and beverage products.

Boomers (aged 58-76) interested in plant based milk products.

Boomers are fine to go without meat for a few days.

Boomers care about the provenance of their food and beverage products.

We delivered a series of workshops for Oatly global leaders, shaping investment decisions and their new market entry strategy.

These tailored briefings empowered participants to define a better, localised strategy going forward, playing back findings and connecting them to opportunities for market growth.

Our summaries of the findings included: audience definition and market sizing, alternative milk target segments, customer messaging matrix, and prioritised purchase moments and channels.

This has set Oatly up for future success in the market, pushing the brand forward with Japanese customers.

A special thank you to all contributors to the program.

James Hollow

CEO / Head of Strategy

Yoko Matsuo

Senior Strategic Designer

Rei Kato

Senior Data Strategist

Soichiro Yanagi

Business Director

Kaoru Sakiya

Japan Marketing Lead